Summary / TLDR

Delta’s motto, currently “Keep Climbing”, seems a bit more apropos these days. On December 10, Delta landed some bad news on price-conscious travelers: its Basic Economy tickets will come with even fewer benefits than before. They will no longer accrue Sky Miles or count towards Medallion status. This pricing move (let’s be clear, it is a pricing move!) was never gonna be a popularity winner, but it will very likely be a big winner for Delta:

- Its impact on profitability is larger than meets the eye, potentially a 2.5%+ margin gain on affected revenue (Delta’s historical “good years” net margin hovers between 7-10%)

- The method (shrinkflation through depriving a service of valuable fringe benefits) is smartly chosen and targeted to nudge even more profitable upgrades to Main Cabin

- The timing (pent-up demand & can’t-change sticky holiday travel plans apply) is ideal to mitigate any costly customer defections

- Change perfectly illustrates a strong organization’s iterative tweaking to optimize pricing segmentation

- We expect, all other things equal (which they never are!) Delta’s profits and share price to ultimately benefit, as customers “complain – but buy anyway.”

Is making Basic Economy a worse consumer choice making Delta a better business?

It’s shrinkflation with a nudge to upgrade / upsell

Delta’s move to further deprive its lowest-priced service level of benefits is shrinkflation in another guise, with some added twists. Shrinkflation generally evokes something shrinking in size (e.g. package content in CPG), with the price of the overall package staying unchanged to decoy the effective price increase. In services and software businesses (including airlines), however, different “tiers” of service or membership are used for price segmentation. Including or excluding benefits/features in the various tiers drives the “offering design” to align the tiers or “packages” optimally with customer segments (or personas) with different willingness to pay (WTP). Then comes the next layer of optimization – price-setting, e.g. charging optimum prices for each tier/package of the offering to harvest as much customer WTP as possible from each segment.

Delta is cutting its costs and making Basic Economy a lesser value, escalating the “discomfort” of our choice to fly cheap. Bottom dwellers in Basic on each particular flight will also be denied hope for aspirational future benefits (“award” ticket, or the ever more elusive medallion upgrade). Delta cleverly makes it look like any loss of benefits is merely the customer’s choice. You and I, not Delta, choose to save a measly $30, $50, or $95 instead of clicking that tempting bright red “Move to Main” button and feeling whole again. That’s the clinch: Main is now an improved value, relative to Basic, while staying exactly the same.

Some customers of any business will cry foul when deprived of something they had come to take for granted or perceive as “free/included.” Does that make it wrong? Or is it misguided for customers to grow inflexible expectations about pricing and terms, all while also expecting businesses to thrive, create jobs, cut costs, evolve and innovate? A quote from John Harrison, a 18th-century innovator who knew something about measurement and navigation, seems apropos:

You know you’re priced right when your customers complain—but buy anyway.

John Harrison Tweet

So, will Delta’s customers keep buying? Further, will more of them embrace the upgrade to Main Cabin that Delta is really after (when in doubt, trust that big red “Move to Main” button)? For reasons I detail below, the answers are likely yes and yes. As a result, Delta should see more favorable mix, higher Average Selling Price (ASP), and ultimately better profits. Unless, as often in the airline industry, some completely unrelated shock comes up to make a mess of it all.

The history of Basic Economy, and the need for pricing segmentation

In understanding Delta’s latest move, it helps to remember why Basic Economy exists in the first place, and that it’s a relatively recent offering. Back in 2015, Basic Economy was introduced as expressly designed to compete more effectively against ULCC’s (ultra low cost carriers). Two factors made it essential to “get it right” in the battle for ultra price-conscious customers:

- The economics of airlines (giant fixed costs, minimal marginal costs), make flying an incremental passenger profitable at nearly any price, if the seat would be otherwise empty. Low cost fares are the indispensable device for filling up incremental seats. Without them, the already thin profit margins of airlines would evaporate.

- Lower fare classes make up the majority of seats and are biggest contributors to revenue on nearly all flights. Further, the “weight” of lower fare tickets in the overall revenues of the industry has been growing steadily, making it impossible for Delta and its peers not to have competitive offerings in this segment.

Delta and its peers got to work, segmenting, tweaking, re-pricing, and at times even over-segmenting to where pretty much any idea seemed a possibility. It took me a while to realize this kind of segmentation “Delta Introduces Comfort Basic Economy+” was in fact an April’s Fool spoof. One had become thoroughly conditioned to airlines coming up with new segmentation tweaks (or desperation moves). But in in an industry whose history is littered with bankruptcies and lengthy streaks of red ink, getting price segmentation right is a survival requirement.

Cannibalization & feature/benefit deprivation: the downsides of pricing segmentation

The trouble with pricing segmentation for Delta or indeed any business is that it’s a two-way street. Anyone with high Willingness To Pay (or willingness to let their employer pay) can self-select themselves into those outlandish price points at which Delta is virtually printing profits (First/Business/Delta One Class). But it also allows any price-conscious traveler, regardless how rich their resources, to choose the cheap route (Basic Economy) if the cheap route is tolerable enough. This is cannibalization, the scourge of every pricing segmentation strategy: potential high-paying customers defecting to the lower-priced option, bleeding profit margins.

To avoid cannibalization, businesses must play a carrot-and-stick game. The higher-priced offerings must be enticing, inspirational, and all around kick-ass (think those airline Business Class ads, sleeping-on-a-cloud, French wines, and ultra-photogenic staff) … that’s the part businesses will make sure you see in ads. But just as surely, the lowest-priced options must be, well, just barely “tolerable enough” to make it look like a really bad idea to settle for, if you can afford anything better. That’s the part businesses typically make sure you see in real life. I would guess having seen that “tolerable enough” in action is why most of us don’t really enjoy “choosing” to fly in Basic Economy any more than we enjoy seeing “the only dentist in our office who is taking new patients.”

What factors may have played in Delta's decision?

Economics: Likely impact on Customer choice & profitability

Any change in prices, features or design of the segmentation must be evaluated against expected change in customer choice mix – what % of customers choose each price point / offering tier (including the all important, what % choose no longer to purchase from this business at all). Let’s consider possible outcomes for each existing customer who would have bought Basic Economy before the change:

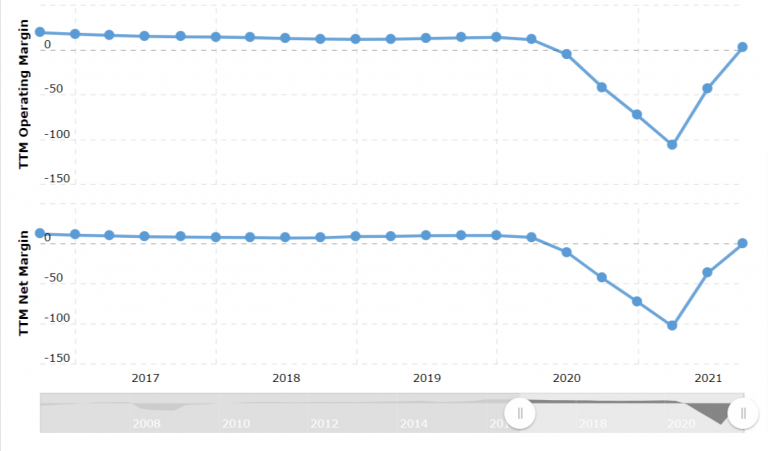

- Option A. Still buy Basic Economy with the diminished benefits (Delta gets same revenue, with lower costs … somewhat the equivalent of shrinkflation). In effect, your fare previously bought you this flight and a small % of a future flight (the SkyMiles), now the latter is no longer in your package. On a $400 Basic Economy fare, you’d get about 1500-2000 Skymiles, (assuming $300 of the $400 total is actual base fare that earns miles, other $100 government-imposed fees etc; then using the 5x or 7x multiplier for General & Silver fliers). This would be worth about $15-20 (Delta’s “Buy With Miles” option pegs each 100 miles = $1), or 4-5% of the original fare. But since most travelers hold their miles for years, the real time value of money of this cost to Delta is more like 2-3% of the fare at most. Let’s call it $10 extra profit per $400 fare. A 2.5% increase in margin on a large chunk of Delta’s total revenue would do wonders for a historically low-margin business (Delta’s net profit margin for the years prior to the pandemic hovered in the 7-10% range). But would this cover the risk / be worth the squeeze (see X below)?

- Option B. Pay for the upgrade to Main (this could be $30/50/95 or more in revenue for Delta, with no material change in cost). In the example in our main picture $348 -> $398, a cool 14% revenue increase with roughly matching 14% of extra profit margin (again, as added to historical 7-10% profit margins, a mouth-watering doubling or tripling of potential profit). Even a relatively small % of customers embracing B will catalyze Delta’s profits … and justify its very obvious efforts to make this path omnipresent in the UX of customers’ choice journey. There are some particular subsets for whom B may be particularly likely: Travelers whose base airport is a Delta hub / already fly disproportionately on Delta, like this outspoken, yet rational one, OR Travelers who already have been earning/saving SkyMiles towards an award / dream trip, and need a few more flights to get there (their next few flights worth of incremental miles have disproportionate “value” to unlock the stash they already earned)

- Option X. Pass on purchase / Switch to alternative (including competitors, rail, road, etc). This is the bad / risk case for any price increase, explicit or, as here, expertly designed to avoid the appearance yet effect the same reality. But this is exactly where Delta’s choice of both “lever” and timing for the price increase is crafty.

Cost of status quo: profitability levels and demand strength

Like all airlines, Delta’s profitability can use any pricing power it can find. For a company hovering at 7-10% net profit margin in very healthy years (see below), the breakeven analysis is generally strongly favorable to price increases, unless they are met with dramatic price elasticity. However one may feel about “fairness” arguments, Delta is doing all the right things to diminish elasticity: a) operating in a highly targeted part of its offering, yet large enough to move the profitability needs, b) making the price increase hard to perceive or quantify by average consumers, c) choosing its timing carefully, with both demand and consumer finances at record strength, and its recent deep losses still in the picture as “fairness” arguments, d) signaling to its major competitors a path they may follow towards higher industry profitability.

Why did Delta choose this type of price action, and why now?

Delta’s choice of lever for this price action provides several benefits:

- It preserves the “measurable” and “comparable” value claims driving customer choice. Delta’s system-wide “packaging change” in its lowest price tier leaves headline fares unaffected. This preserves its positioning in all-important price-comparison engines, mitigating customer defection risk. Basic Economy price points, Delta’s lowest available, remain purposefully attractive top-of-funnel advertisements for Delta’s affordability, In its presentation / communication of value proposition, Delta gets to tell the same story as before, and for all but the most attentive consumers, the story and the price comparison engines are all we got.

- It widens, rather than narrows the pricing segmentation “hedges”. For pricing segmentation to work, the “hedges” between the offering tiers must be wide enough in terms of features/value of the offering for each tier / customer segment, to provide clear differentiation in value received. Otherwise, settling for the lower-value offerings becomes more attractive since a material price differential can be saved for a relatively small sacrifice in value/features. Delta is clearly widening the hedge between Basic and Main here, making paying the extra $50 for Main seem a better choice than before.

- It leaves the price levels themselves as “dry powder.” Delta preserves its options to use dynamic pricing, as always, to further optimize profitability. For example, if all goes well Delta may also raise prices on Basic by a few dollars on select flights. Or it may lower prices on Main on targeted routes / flights, to increase uptake of that all-important Main Cabin upsell. With dynamic pricing, changes in actual price points are much faster, easier to target down to each flight, calibrate, and even reverse. By contrast, changes in the offering design are stickier, and can’t be implemented too frequently given their execution and communication costs.

- It decouples the pain from the gain timing-wise. With this move, the consumer preserves the gain (flying at a low cost) now, while the incremental cost (the loss of benefit from future SkyMiles awards) is delayed to a future time. This is a proven behavioral economics “nudge” tactic to increase conversion / decrease switching risk. One of the most successful financial innovations of all time, the credit card, fundamentally relies on increased consumption choices when the pain (paying off the bill) is decoupled from the timing of the purchase.

- It provides short-term cushions from the adverse impact. In the short term (through Jan 2022), Delta is smartly providing waivers for free cancellations, changes and off-ramps to mitigate the impact on consumers most hurt and whose impact would register closest to the actual change: those who already purchased Basic Economy or will do so in the immediate future. Giving customers an out from contracts struck at the “old” terms that Delta will no longer abide by is smart business, and part of most well-designed price increases. In effect, Delta is saying: we’re so confident this will still be better than your alternatives that we’re giving you the freedom to make your choice all over again.

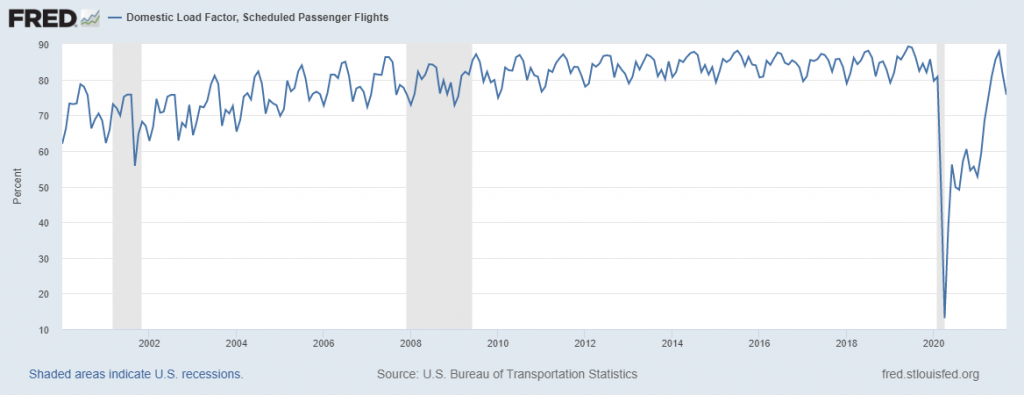

Expert timing, capitalizing on strong demand.

Note that even Option X (customer passes on purchase / defects to alternative) won’t “hurt” Delta’s profits unless it results in an empty seat. But amidst booming demand, Basic Economy would be full either way. Other customers would readily readily replace any “defector” from the cheap seats. Especially over the holidays, and during a pandemic rebound, more people are making travel plans they are more intent on keeping. US domestic flights getting close to record load factors from profitable pre-pandemic years. Simply put, the demand, particularly for Basic Economy, is making the supply more valuable, and Delta is smartly cashing in.

Final thoughts

My money is on this move working well for Delta, and on its competitors following suit soon.

- Delta’s choices here check most boxes for a master class in pricing strategy and execution.

- Risks (primarily from external shocks) are always part of life in pricing, and more so in politically- and geo-politically sensitive industries like airlines. Even the best played individual hand is still not immune from humbling results, but over the “long game”, the compounded effect of smart pricing moves is dramatic overperformance.

- Delta is showing a high-class willingness to iterate and learn across its offering design and price setting strategy. Its commitment to invest and take calculated risks through sophisticated pricing segmentation position it to be one of the “long game” winners of the airline industry.

Customers in Basic Economy will find Delta’s old slogans appropriately out with the old: 1994: You’ll Love the Way We Fly 1997: On Top of the World 2005: Good Goes Around … and the current one: Keep Climbing perhaps at best a reminder it’s all about that upgrade.